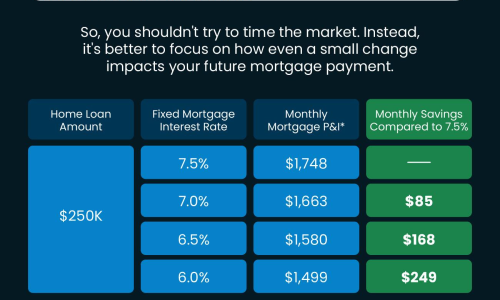

Experts say rates will come down slightly in the year ahead – but some volatility is expected. So, you shouldn’t try to time the market. Instead, it’s better to focus on how even a small change impacts your future mortgage payment. As rates come down, even a little bit, your monthly payment on your next […]

Get Ready To Buy a Home in 2025

If buying a home is on your goal sheet this year, here’s how to make it happen. Focus on improving your credit, planning for your down payment, getting pre-approved, and prioritizing your wish list. But first, let’s connect so you have expert advice every step of the way.

Why More Sellers Are Hiring a Real Estate Agent

More homeowners are realizing they need an agent’s help in this complex market – and that’s why a record-low number of people are selling without a pro by their side. Without an agent’s help, tackling pricing, staging and repairs, paperwork, negotiation, and more can be a real headache. Selling without a pro isn’t worth the […]

The Truth About Down Payments

There’s a misconception going around that you have to put 20% of the purchase price down when you buy a home. But the truth is, many people don’t put down that much unless they’re trying to make their offer more competitive. And if you want to give your savings a boost, look into down payment […]

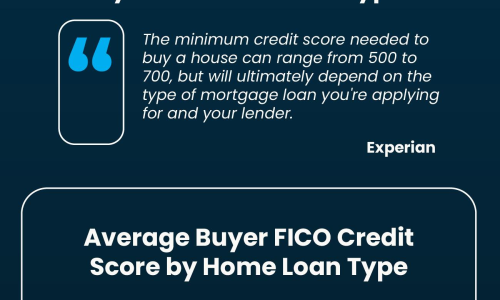

What Homebuyers Need To Know About Credit Scores

Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type. According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home. Your credit […]

Why This Winter Is the Sweet Spot for Selling

Thinking about selling your house? Here are a few reasons why you may want to do it this season. Buyers looking right now are serious about moving and the number of homes for sale is typically lower this time of year – helping your house stand out. While inventory is higher this year than it’s […]