Why You May Want To Start Your Home Search Today If you’re thinking about buying a home, you likely have a lot of factors on your mind. You’re weighing your own needs against higher mortgage rates, today’s home prices, and more to try to decide if you want to jump into the market. While some buyers […]

Why a Home Inspection Is Important

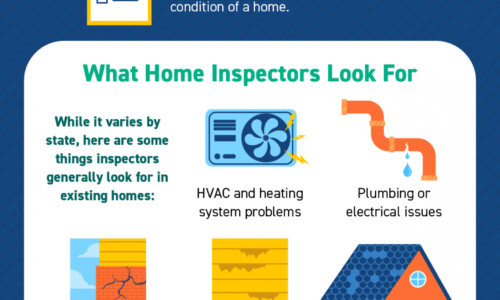

Why a Home Inspection Is Important [INFOGRAPHIC] Some Highlights If you’re buying a home, here’s what you should know about your home inspection and why it’s so important. A home inspection is a crucial step in the homebuying process. It assesses the condition of the home you plan to purchase so you can avoid costly surprises down the road. Let’s connect so […]

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?

Is the Shifting Market a Challenge or an Opportunity for Homebuyers? If you tried to buy a home during the pandemic, you know the limited supply of homes for sale was a considerable challenge. It created intense bidding wars which drove home prices up as buyers competed with one another to be the winning offer. But what was once […]

Selling Your House? Your Asking Price Matters More Now Than Ever

Selling Your House? Your Asking Price Matters More Now Than Ever There’s no doubt about the fact that the housing market is slowing from the frenzy we saw over the past two years. But what does that mean for you if you’re thinking of selling your house? While home prices are still appreciating in most markets and experts […]

Why the Forbearance Program Changed the Housing Market

Why the Forbearance Program Changed the Housing Market When the pandemic hit in 2020, many experts thought the housing market would crash. They feared job loss and economic uncertainty would lead to a wave of foreclosures similar to when the housing bubble burst over a decade ago. Thankfully, the forbearance program changed that. It provided much-needed […]

Buying a Home May Make More Financial Sense Than Renting One

Buying a Home May Make More Financial Sense Than Renting One If rising home prices leave you wondering if it makes more sense to rent or buy a home in today’s housing market, consider this. It’s not just home prices that have risen in recent years – rental prices have skyrocketed as well. As a recent article from realtor.com says: “The […]