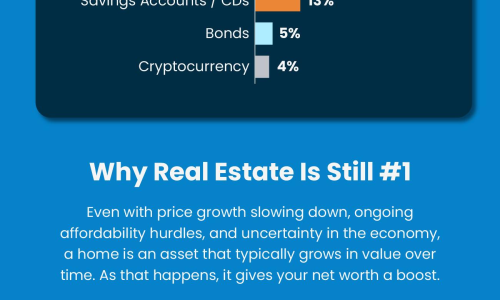

In a recent poll from Gallup, real estate has once again been voted the best long-term investment. And it’s claimed that top spot for 12 straight years now. That’s because homeownership is one of the top ways to build your wealth, even with home price growth moderating and ongoing economic uncertainty. If you’ve been trying […]

Why You’ll Want a Home Inspection

Once your offer is accepted, an inspector will assess the condition of the house, including things like the roof, foundation, plumbing, and more. That information is incredibly important and paves the way for you to re-negotiate with the seller, as needed. So, you don’t want to skip this step. An inspection is your chance to […]

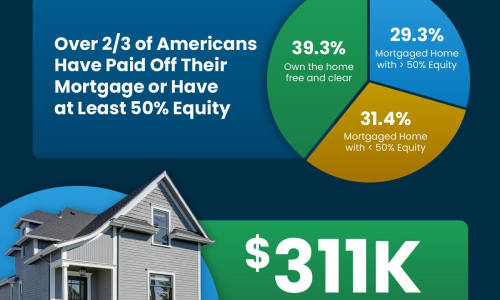

Your Home Equity Could Make Moving Possible

Thanks to recent home price appreciation, homeowners have near record amounts of equity – and you may too. On average, homeowners have $311K worth of equity. Once you sell, you can use it to fund your down payment on your next home or maybe even to buy a smaller house in cash. If you want […]

If the Asking Price Isn’t Compelling, It’s Not Selling

Unfortunately, a lot of sellers today are setting their asking price too high. That’s leading to an uptick in price cuts. Some of the most common reasons this is happening are that they’re not paying attention to current market conditions or they’re trying to leave room for negotiation. The best way to avoid this mistake? […]

A Recession Doesn’t Mean a Housing Crisis

There’s a lot of talk about a recession lately and how the odds of one are rising. If you’re wondering what that means for the housing market, here’s what the data tells us. While you may remember the price crash in 2008, that’s not the norm. Looking back all the way to 1980, home prices […]

Things To Avoid After You Apply for a Mortgage

Once a lender has reviewed your finances as part of the homebuying process, you want to be as consistent as possible. Don’t make any big changes that could affect your mortgage application. Here are a few tips. Don’t change bank accounts or apply for new credit. And this one may surprise you, don’t buy appliances […]